Marketplaces growth and trends

Markets around the world have borne the brunt of the Covid-19 pandemic. And the European market is the most obvious witness to this.

The European retail sector experienced significant difficulties in 2020. However, the pandemic has also been a catalyst for online sales. Driving European shoppers in more mature markets to buy online more than usual. And shoppers in less mature markets to buy online for the first time. Brands that have not yet set their sights on Europe should take notice – its online shopping audience rivals only China in size.

We’ll take a look at the effects of the pandemic on the market. And what you should know if you want to expand into Europe.

European shopper habits in 2020

Overall, European shoppers are spending more time shopping online. Western and Northern Europe have the highest e-commerce penetration rates. While in Eastern and Southern Europe, especially in Spain and Italy, more shoppers are trying online shopping for the first time. A trend that is expected to continue in the coming years.

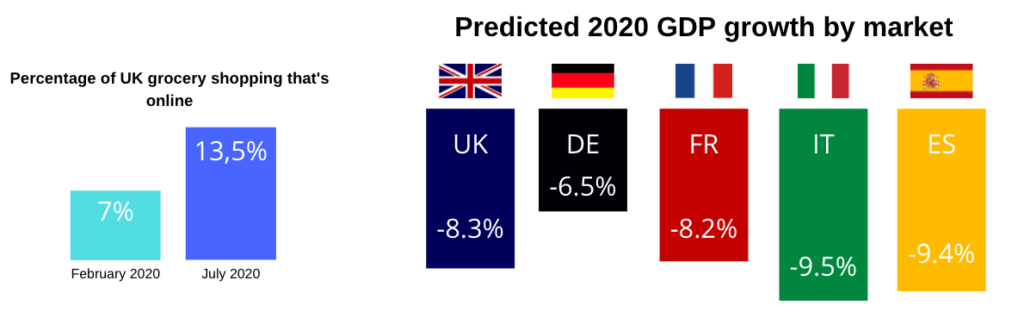

Although we do not yet have a complete picture of the current year. Here is the level of penetration in the markets in 2020. In the UK, the percentage of grocery purchases made online has increased from 7% of the total in February 2020. To 13.5% of the total in July 2020.

The direct-to-consumer shift

European and non-European brands are taking note of D2C trends. Overall we see that Europe has a much more fragmented offline retail landscape. In addition, many of the strongest offline players are starting to digitalize and move online.

One trend we are seeing this year is that brands are putting more emphasis on their direct-to-consumer websites. Rather than third-party online or omnichannel retailers. These sites are being used to complement existing channels rather than compete with them.

The rise of marketplace in Europe

One of the most noteworthy trends we’re seeing in 2020 is the rise in the popularity of online marketplaces. Compared to the US or China, Europe has been slower to take to marketplaces. But they’re becoming an increasingly important online route of entry for brands across the globe. Attempting to get a slice of the European market.

In the past few years, and especially in 2020, online marketplaces in Europe have attracted significant traffic. And seen high visitor engagement that has translated into sales. They accounted for 59% of the 143 billion euros spent on cross-border e-commerce by Europeans in 2019. According to Cross-Border Commerce Europe.

We don’t know if marketplaces will become as dominant in Europe as they’ve become in the US and China. But we do know that brands need to get the formula right for their other channels. Or they’ll miss out on the coming e-commerce growth. The marketplace brand that should be looking at especially close is Amazon.

You can learn more about the rise of marketplaces and their domination in Europe here.

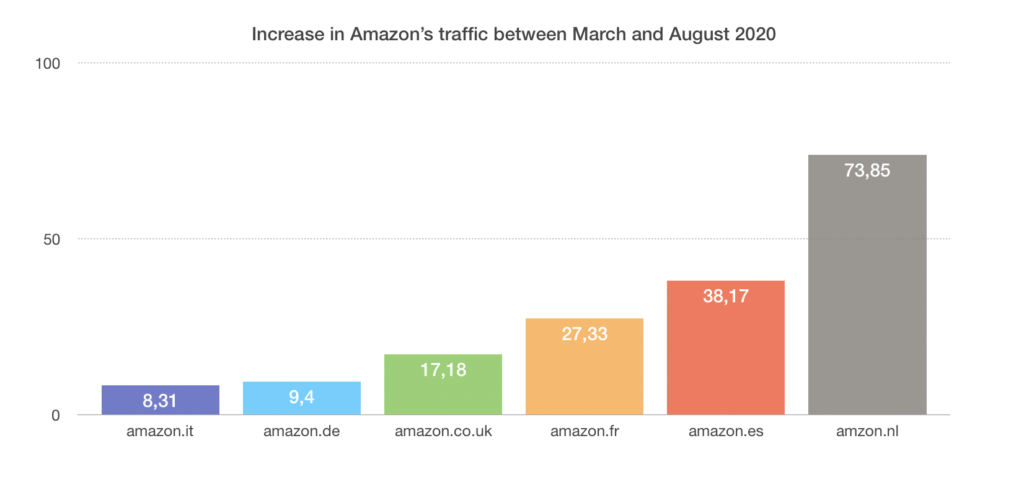

Amazon

During the lockdown, European consumers turned en masse to Amazon for their purchases. Largely for reasons of convenience, delivery but also price. There are nearly 300 million unique visitors to Amazon’s six main European sites each month. And the platform’s traffic grew in every European market during 2020. With visits up 17% in the UK and 9% in Germany between March and August 2020. In addition, Amazon is estimated to have a share of around 30% of the UK and German e-commerce markets.

Amazon’s order fulfillment capabilities, particularly next-day delivery, and its ability to offer high-demand products at consistently lower prices than competing retailers have been central to its success in the region. As well as its ability to offer high-demand products at consistently lower prices than competing retailers have been central to its success in the region. During the closure period, the top-selling categories on the platform were consumer electronics, toys and games, health, and beauty. And home and kitchen. All reflecting the changing lifestyle of people staying at home.

Brands in less digitally mature markets are taking a keen interest in Amazon as a sales channel. With the imminent launch of the marketplace in Poland and Sweden, we expect Amazon’s market share in Europe to continue to grow.

Overview of the three main European markets in 2020

1. The United Kingdom

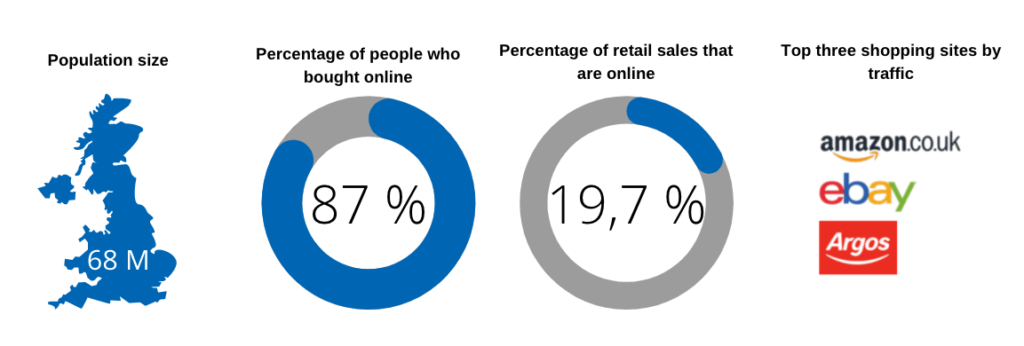

The UK has a population of 68 million, and 87% of the population bought online in October. In August, online sales were up 43.5% year-on-year in the country. Since the start of the containment measures in March in the UK, online channels have become very important and sales have been sustained in the country.

Amazon.uk, eBay, and Argos are the top three shopping sites in terms of traffic. Omnichannel retailers have also seen a 70.5% year-on-year increase in online sales in the UK. Partly because many retailers have launched Covid secure click and collect services to bypass delivery delays.

2. Germany

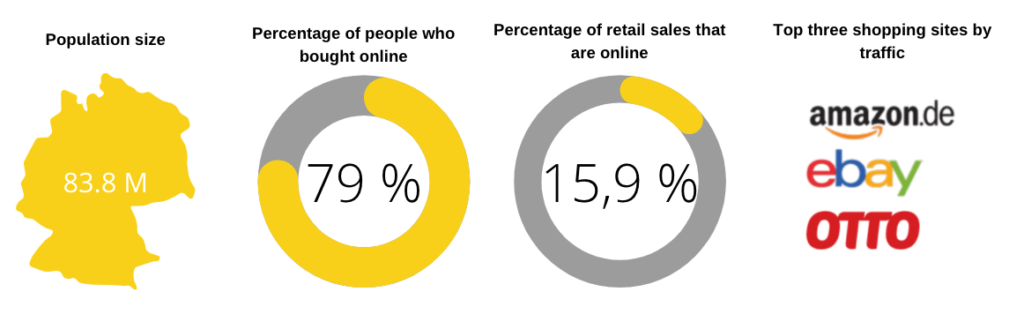

Germany has the largest online shopping audience in Europe and presents a significant sales opportunity for brands. Especially as the German economy has suffered less than others in 2020.

The pandemic has accelerated the digitalisation of German retailing at all levels. The top three shopping sites in Germany are all marketplaces. Amazon once again holds the top spot, and marketplaces accounted for at least 40% of German online sales even before the pandemic.

3. France

France is another mature marketplace in Europe that’s seen heightened competition on sites like Amazon and eBay due to retail closures. It’s estimated that retail eCommerce sales in France will rise by 17.1% by the end of the year, with the increase driven by the nation’s strict lockdown restrictions in comparison to other European markets.

How Powerlab can enhance or start your e-commerce in Europe

Increasing e-commerce penetration rates are a reality in the European market, but with the rise of online marketplaces in Europe. With the rise of online marketplaces in Europe, and Amazon, in particular, retailers and brands need to differentiate themselves through the customer experience they offer on websites. If they want these channels to generate additional sales.

Success in the region requires a balance of multiple online channels to serve customers. That’s where Powerlab comes in.

We connect you with teams on the ground who have the resources and technology to help you enter the market. And help you deliver an exceptional e-commerce customer service experience.

To find out more about international e-commerce and how your brand can thrive in the e-commerce space, contact us.

If you’re interested in the subject of e-commerce, have a look at these articles. You might like them.