Logistics market hits new records in Europe

The logistics market, up 29% in the six major countries, has set a new record for transactions in 2021. Several regions recorded new highs. However, the pace of warehouse construction is lagging behind demand, and greenfield developments remain limited. The shortage of materials further exacerbates the situation by causing delays in new real estate projects. While access to land is another limiting factor. With strong demand and less balanced supply, rental pressures are increasing.

Growth in six countries in 2021: +29% (compared to 2020)

A new record of transactions has been set in Europe in 2021 with growth in all countries, driven by online sales and overall economic recovery.

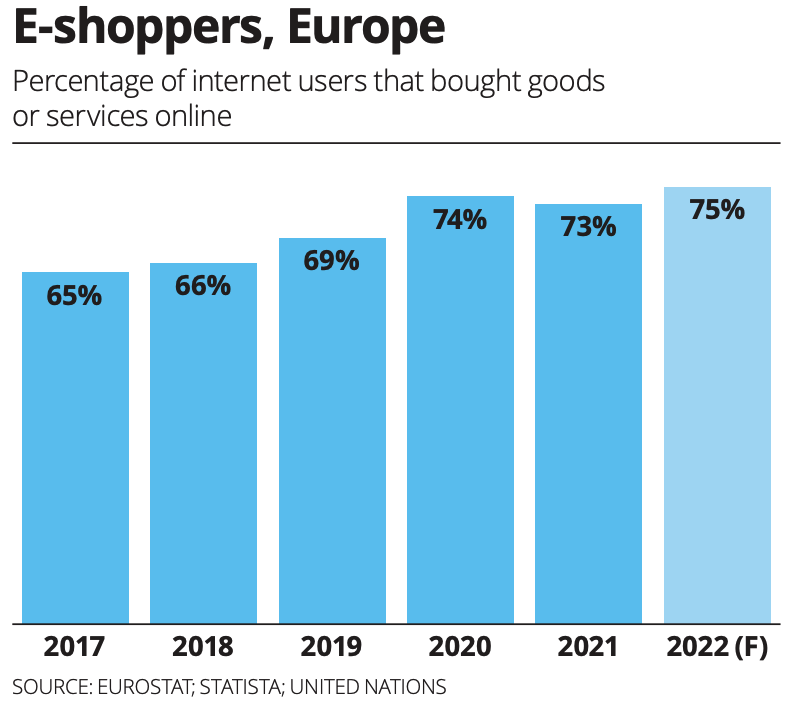

The marked changes in consumer behavior brought about by the Covid-19 crisis have encouraged online shopping and allowed e-commerce to expand into less mainstream markets, boosting demand for logistics.

Supply has dried up over the last three years while demand has remained strong, causing significant imbalances in some markets. This has been particularly noticeable in prime areas, where demand has shifted to other regional locations.

Completion times and availability of land will determine the balance of the market in areas where the vacancy rate is well below the European average of 5% in 2021. New building projects are still insufficient to meet demand, but few speculative projects have been launched.

Country profiles in 2021

In Germany, the logistics market has been firing on all cylinders to reach a new record volume of transactions in 2021, driven by e-commerce. The logistics sector has weathered the crisis better than almost all other sectors of the economy.

The UK has set a new record in 2021, with 6 million sqm of space sold. Market growth has been supported by a strong economic recovery (+7.1% in 2021). Given the slight contraction of projects in the pipeline and the good market dynamics, long-term yields are expected to be stable with continued rental growth.

In Poland, rental transactions had another record year. The pandemic fuelled the already strong growth in e-commerce and strong economic growth (+5.2% in 2021) supported the market.

In France, after a slow start to the year, the market gained momentum thanks to strong activity in Paris and Lille and sustained GDP growth (+6.7% in 2021), among the highest in Europe. Overall, supply remains tight in most markets.

In the Netherlands, transactions have reached a new record high in 2021. Against a background of low availability in the main logistics hubs, users continued to move to other locations. Rents are stabilizing, but strong demand and low availability still exert some upward pressure.

In Spain, transaction volumes reached a new record high of over 2 million sqm in 2021. Activity has been driven by online sales and food retailers as well as strong economic growth (+4.3% in 2021). Vacancy rates remain very low, contributing to upward pressure on rents, particularly in Barcelona.

Strong market drivers

Accelerating vaccination campaigns in Europe and the economic recovery in Europe in 2021 have boosted demand for warehouses. Covid-19 has driven the transition to e-commerce and put a focus on supply chains. Shoppers have turned to online sales and traditional retailers have developed online solutions for their customers. The transformation of the retail sector in connection with the rise of e-commerce is far from complete. It will continue to affect the demand for logistics for at least the next five years.

The organization of logistics will change in the longer term

Rather than inflating stocks to counteract supply chain problems, companies can set up dedicated logistics networks that minimize distribution costs and move goods more quickly. Supply chain optimization thus remains an important driver for the future occupation of logistics space, especially at the local and regional levels.

The design and operation of logistics platforms play a key role in the smooth functioning of supply chains. End-user-driven developments will contribute to the transformation of the supply chain.

In recent years, much of the demand has been driven by the demand for warehouses to store and distribute finished products manufactured much further away. The Covid-19 crisis has prompted companies to relocate some of their manufacturing processes back home. Therefore, this provides an opportunity for increased demand.

The coronavirus epidemic has increased the penetration rate of e-commerce

Demand for logistics space is driven by e-commerce activity covering a wide range of goods and the Covid-19 crisis has had a positive (if sometimes mixed) impact. It has accelerated demand in some areas and halted it in others, depending on the items purchased and their provenance.

The medium to the long-term evolution of consumer behavior will normalize online shopping. They will help to increase the penetration of e-commerce in markets where it has so far been limited, thereby boosting demand.

The need to bring the supply chain closer to the end consumer is driving the demand for “last mile” logistics, both delivery, and collection. More warehousing specifically dedicated to reverse logistics may be needed to handle the increasing returns.

Do you have a question or simply want to give us your opinion? Do not hesitate to contact us.

To keep the momentum going, we suggest you read these articles: